Multi Credit Moneylender System User Guide

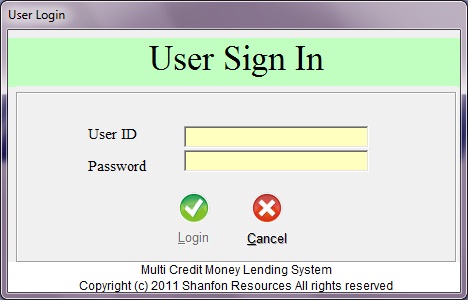

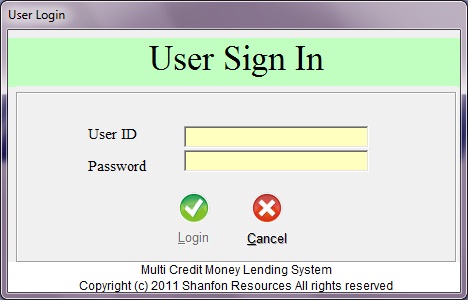

System Login

- Key in given User ID and password.

- Click

Button to login.

Button to login.

- Click

button to abort.

button to abort.

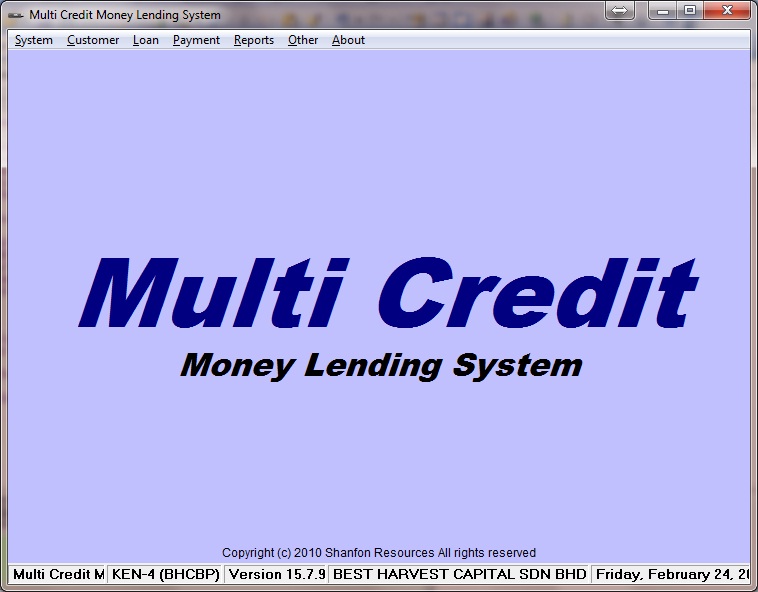

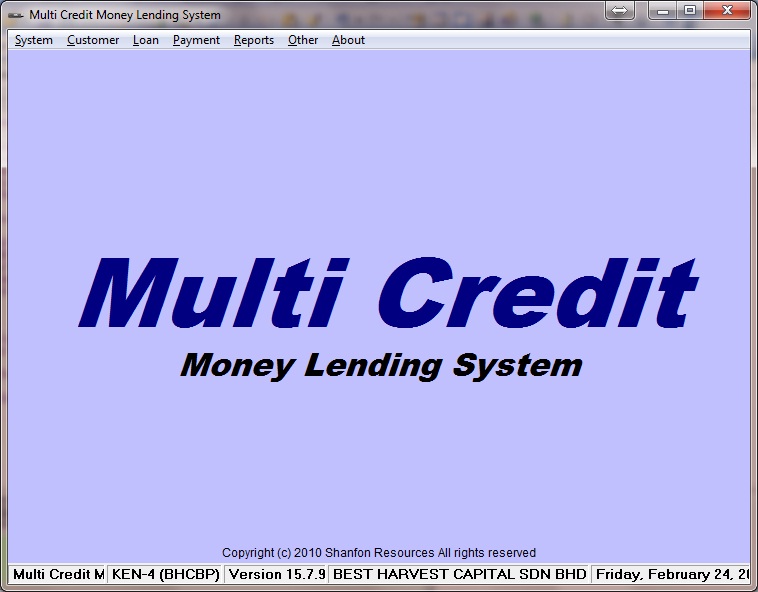

System Main Screen

- System - User Logout to quit to

system

- Customer - Input

Customer Profiles,

Check IC, and

Buy Gold

- Loan -

Input Loans Record, Close loan, open

loan and Delete Loan

- Payment -

Input Payment Record, Delete Payment

- Report -

Main Report, Transaction Report, Analysis Report and

Easy Report

- Other -

Follow Up,

Expenses, Sell Gold, Loan Summary,

Change User Password

Multi Credit Moneylender System User Guide

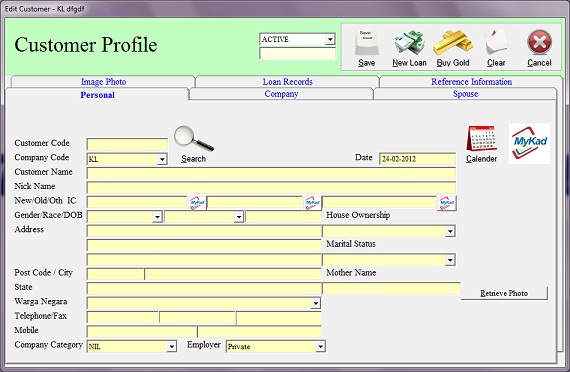

Customer Profile

To create new

Customer Profile

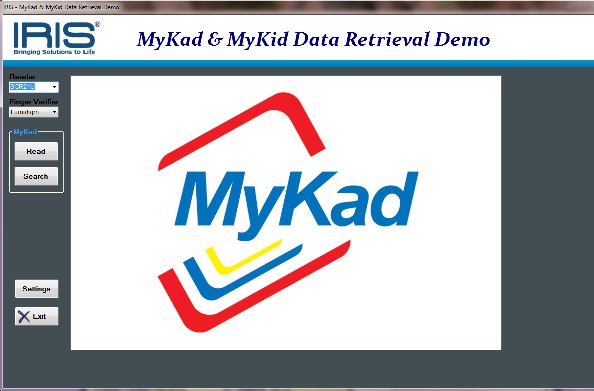

Customer With MyKad

-

Leave the Customer Code in blank.

-

Click

button.

button.

- Click

button.

button.

- After MyKad information show,

click

button to exit.

button to exit.

- MyKad record will be fill into the

customer profile.

- Fill in the rest of the field eg.

Contact No, Company, Spouse, Images Photo and Reference if any.

Customer Without MyKad or MyKad

cannot be read

- Manual fill in all customer

particulars eg. Name, New IC no, Old IC No, Address and so on.

- No MyKad photo will be extract,

user to manual scan the MyKad and add into Image Photo.

Saving Customer Profiles

- click

button to save customer profile, customer code will be auto generated.

button to save customer profile, customer code will be auto generated.

- Customer Code will be share across

all branches.

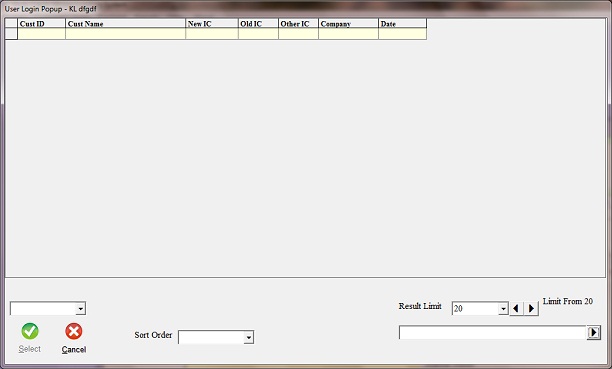

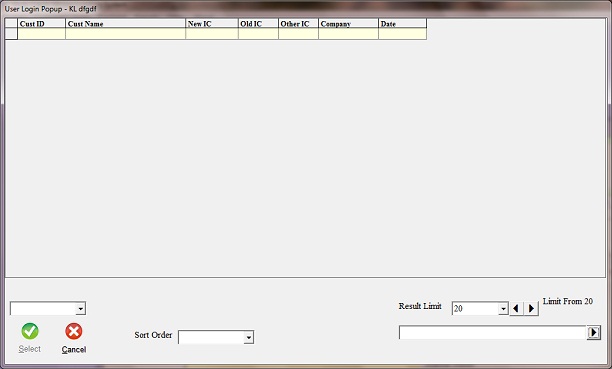

Read Existing

Customer Profile

- To read Customer Profile

- You can key in customer New IC

in the Customer Code, customer IC must with -, eg 801201-10-3551.

- You can key in Alternate Code

in the customer Code.

- To Search Customer profile.

- Click

button.

button.

- Fill in any key words to

search customer profile.

- Key words can be part of the

following field.

a. Customer Name

b. New IC

c. Old IC

d. Other IC

e. Mobile No

- Result Limit defaulted to 20

and can select to 10, 20, 50, 100, 250 & 500, the more limit select may

cause slow loading process.

- Company code to drill down

just for that branch customer profile only.

- Sort Order to select either

sort by customer code or customer name.

- Once confirm then click

button to get the Customer Code.

button to get the Customer Code.

- Key in Customer

New IC in the Customer Code will able to see all branches Loan Records.

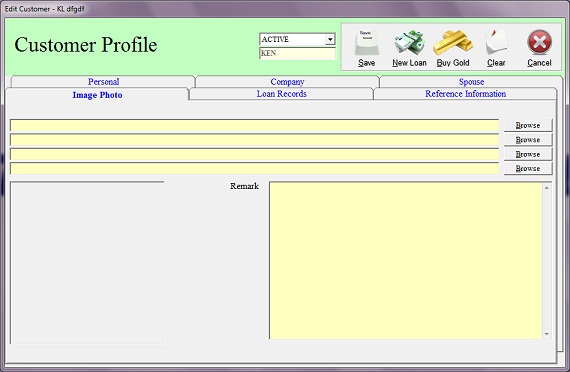

Image Photo

- 4 additional customer photo can be added in here, click

button to browse the photo at your local drive.

button to browse the photo at your local drive.

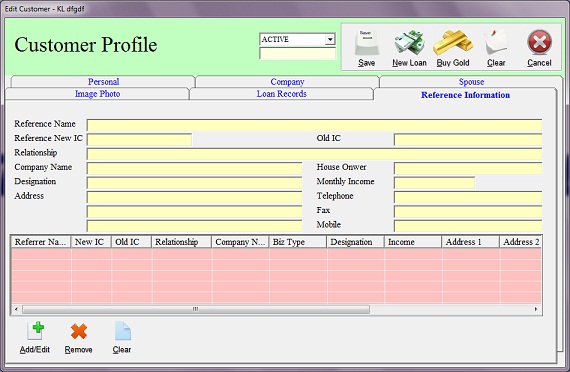

Save Reference Information

- Retrieve customer profile, go to

Reference Information tab.

- Fill in Reference particulars show

as above image.

- Click

button to temporary save Reference details into Reference List and ready

for next Reference detail.

button to temporary save Reference details into Reference List and ready

for next Reference detail.

- Click

button to remove unwanted Reference detail.

button to remove unwanted Reference detail.

- Click

button to clear Reference detail and ready for next Reference.

button to clear Reference detail and ready for next Reference.

- Final

button to save customer profiles otherwise all new added Reference will not

be save into database.

button to save customer profiles otherwise all new added Reference will not

be save into database.

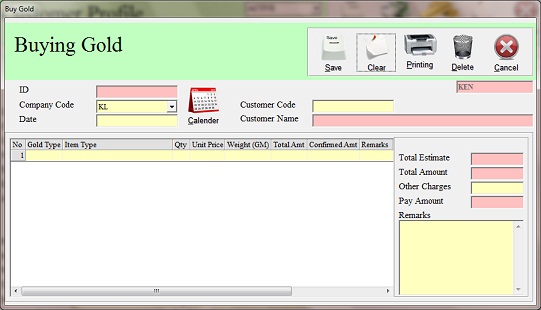

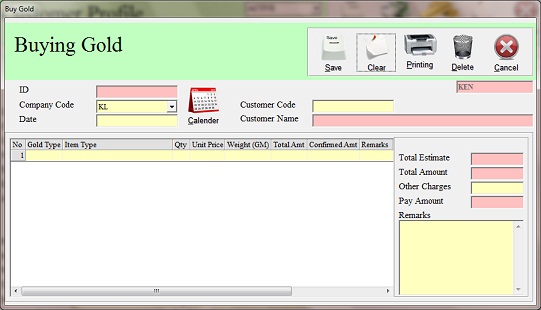

Buy Gold

- Retrieve Customer Profile and click

button.

button.

- Customer Code and Customer Name will be

auto fill in.

- Click Gold Type to select from pre-defines gold

type.

- Fill in Item Type, eg Necklace, golden ring, ear

ring, etc.

- Fill in Qty, Unit Price, Weight (GM)

and Total Amt will be calculated automatically.

- Confirmed Amt is the actual buying amount from

customer.

- Fill in Other Charges if any.

- click

button to save to entry.

button to save to entry.

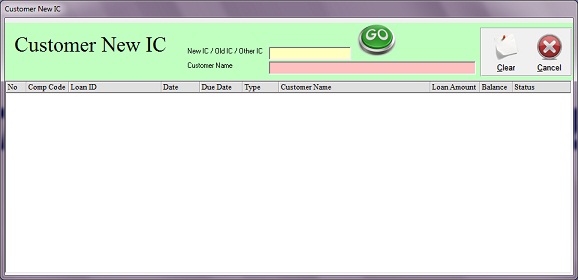

Check IC

- Key in customer New IC, Old IC or

Other IC.

- Click

to retrieve customer loan and guarantor information.

to retrieve customer loan and guarantor information.

- The result will

show in 2 color, yellow color is own loan and pink color is as guarantor.

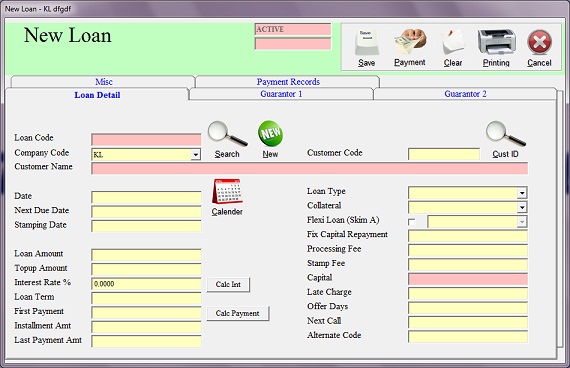

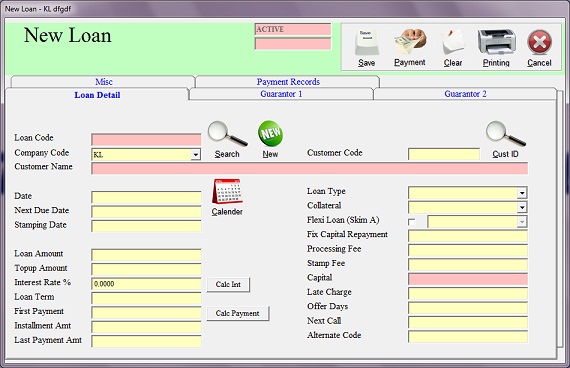

Add New Loan

- Retrieve Customer Profile and

click

button.

button.

- New Loan screen will be call out, Customer detail will be

auto fill.

- Fill in Loan Date, Loan Type as MONTH and

Next Due Date

will be auto fill in but can change.

- Leave the Stamping Date blank unless you know when you

will stamp the Loan Schedule Agreement.

- Fill Loan Amount, Interest Rate % (per

month) and Loan Term

(number of installment).

- Click

button to auto calculate the First Payment, Installment Amt

and Last Payment Amt.

button to auto calculate the First Payment, Installment Amt

and Last Payment Amt.

- The First Payment, Installment Amt and

Last Payment Amt can be change, it will reflect the total loan balance,

remember to click

button to auto count the actual Interest Rate %.

button to auto count the actual Interest Rate %.

- Capital is the amount that you pay to customer after

deduct the Processing Fee and Stamp Fee.

- Late Charge will be impulse during the payment

when customer pay late by comparing the due date, late charge can be waive

anyway.

- Offer Days is the number of day that you offer to

customer when they pay late, eg Due date is 01-03-2012, offer days is 3, pay

date is 10-03-2012 total late is 9 days but customer entitle 3 days offer

meaning he will be charge late interest at 6 days.

- Next Call is the Follow Up date which to call

customer to chase the payment.

- Alternate Code is your own code which easier for

you to retrieve customer profiles, loan record and making new payment.

- Choose either Secured or Unsecure under Collateral field.

- Flexi Loan (Scheme A) for monthly interest loan,

Loan Term must be in 1 and select Interest Pay First.

- Fix Capital Repayment will show in Payment Screen

to remain to collect the capital payment.

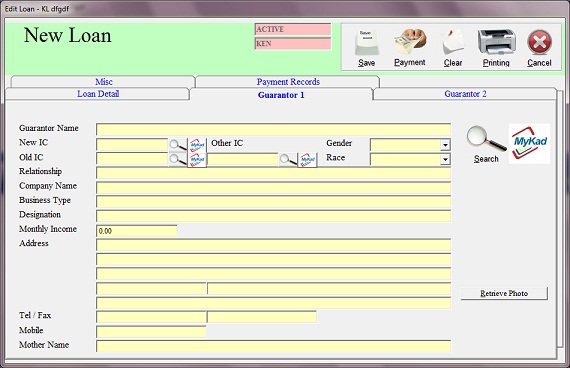

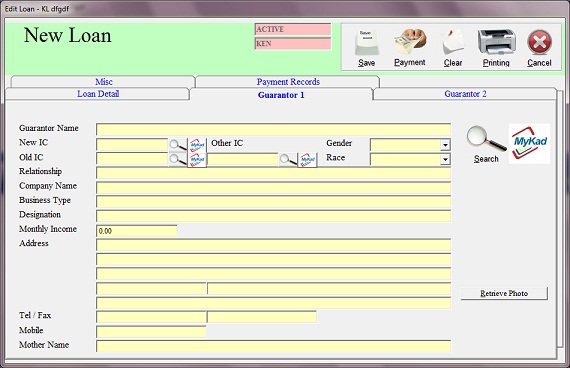

- Guarantor

- Several way to input Guarantor detail, use

button to search from existing customer profile, or

button to search from existing customer profile, or

- Client

button to read from guarantor MyKad, or

button to read from guarantor MyKad, or

- Fill in guarantor New IC or Old IC or Other IC and

click the

button to retrieve from previous loan guarantor detail.

button to retrieve from previous loan guarantor detail.

- Click

button to check the guarantor loan history and the loan guaranteed.

button to check the guarantor loan history and the loan guaranteed.

- Click

button to get guarantor's photo from server.

button to get guarantor's photo from server.

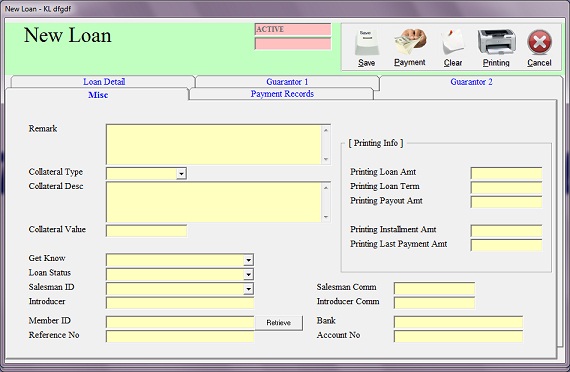

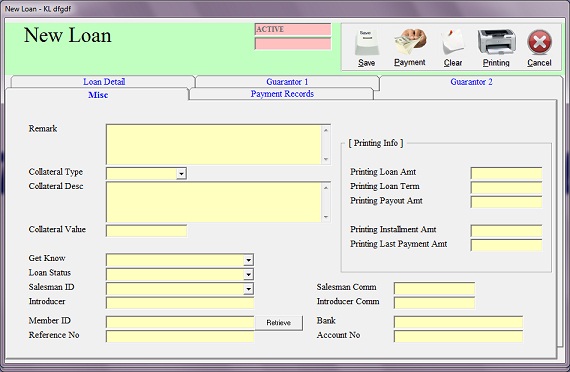

- Misc

- Collateral Type is compulsory when the loan type

is Secured loan, choose from pre-set collateral type, fill in the

Description and Value, the description and value will be printed

at Schedule K.

- Select the appropriate Loan Status to best

describe the loan behavior, Bad Debt are compulsory to select when

the loan gone to bad debt.

- Member ID, Reference No, Bank and Account No can be

retrieve by click

the button.

the button.

- Printing Info will be print the Schedule J for

unsecure loan or Schedule K for secured loan.

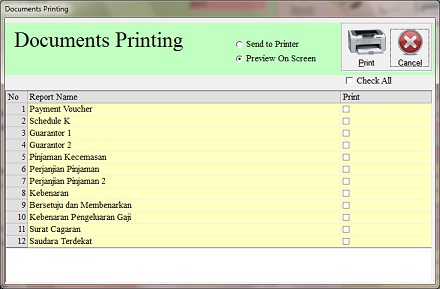

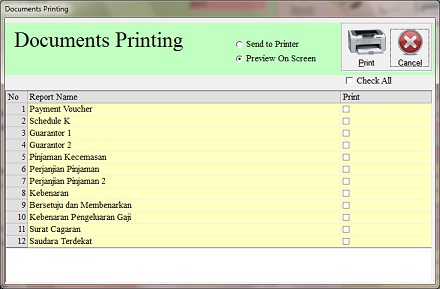

- Click

button to print loan documents.

button to print loan documents.

- Select which document to print and click the

button.

button.

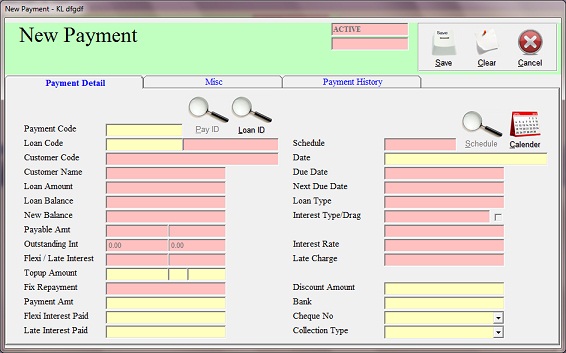

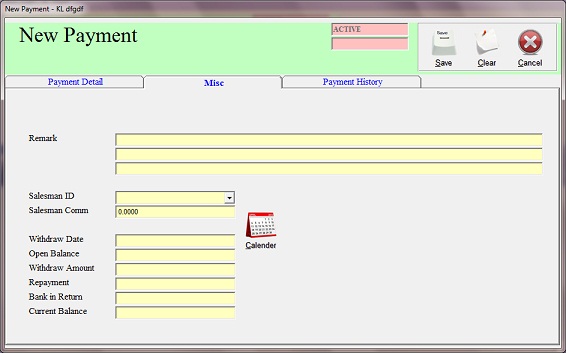

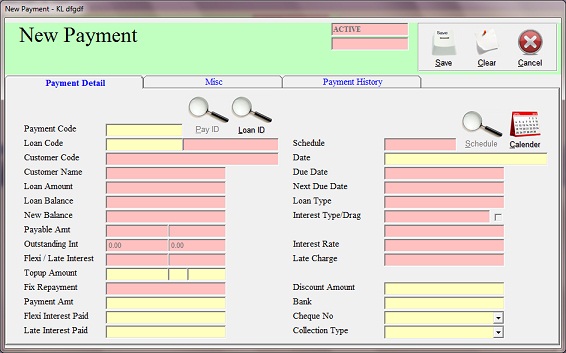

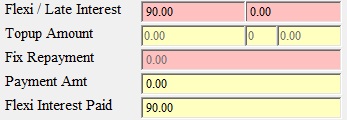

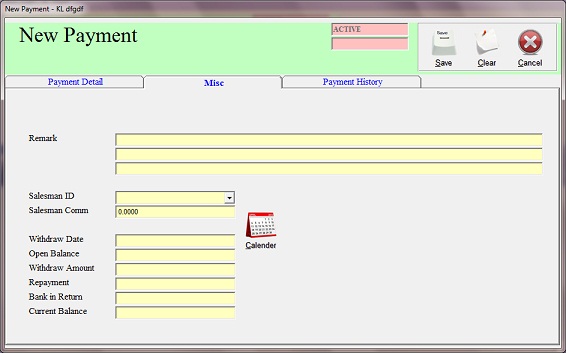

Payment

- Retrieve Loan detail and Click

button.

button.

- New screen will show as above image, loan detail will be

auto fill in.

- Fill in Payment Date.

- Fill in Payment Amt for scheme loan or Payment

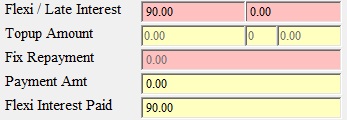

Amt and Flexi Interest Paid for Scheme A loan.

- System will calculate the Scheme A Flexi Interest in pink

color field and collection at yellow color field, eg system calculate scheme

A interst charge as 90 and collection at 90/

- If the Flexi Interest Paid (yellow color) is less

than the Flexi Interest Charge (pink color), system will keep track

that the loan have outstanding Flexi Interest balance.

-

For loan Early Settlement, fill in the full loan

balance amount and fill in the Discount Amount for settlement, eg

Loan Balance 1000 agree to settle the loan at 800, Payment Amt to put

1000 and Discount Amount to put 200.

- Select

Collection Type as Top Up for Scheme A loan

Top Up, the top up amount will be added into existing loan balance.

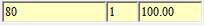

-

Topup Amount first column is the amount that you

pay to customer, second column put 1 and third column put what customer will

pay back, eg. customer top up 100 and on hand get 80, fill in as

- Fill in Remark if any.

- Click

button to save the payment record.

button to save the payment record.

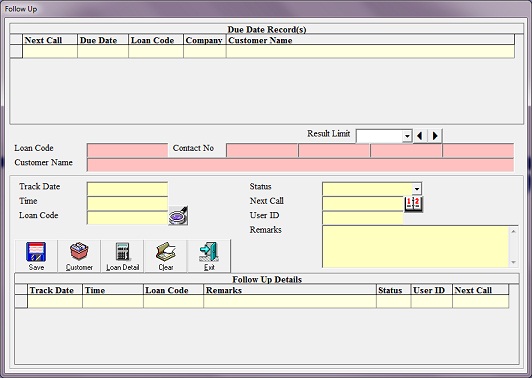

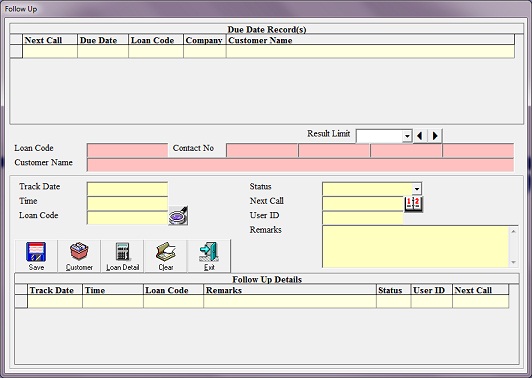

Follow Up

- Follow Up will show whatever loan on due.

- Double click on the loan list, loan detail in Contact No and Customer

Name will be show.

- Make a call to customer and record the conversation in the Remarks

column.

- Select the pre-define Status for the conversation type.

- Fill in the Next Call date which will be appear back in the list

when the current date are greater or equal to the next call date.

- click

button to save to entry, the conversion will be store in the bottom list

which can be double click to show up again.

button to save to entry, the conversion will be store in the bottom list

which can be double click to show up again.

- Click

button to view the customer profile.

button to view the customer profile.

- Click

button to view loan detail.

button to view loan detail.

- New function added to allow user to select Bad

Debt only or all and allow to sort by Next Call, Company Code and Customer

Name

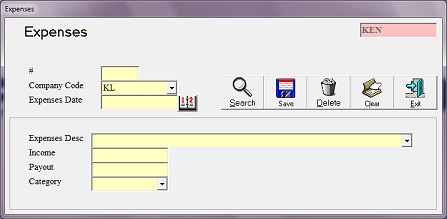

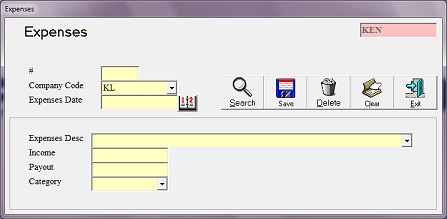

Expenses

- Expenses to record cash

flow in and out others than Loan, Buy Gold, Payment & Sell Gold

- Click

button to search existing expenses record.

button to search existing expenses record.

- Fill in Expenses Date.

- Fill in Expenses Description eg. Salary for the

month of 02-2012, Office Rental, Electric Bill, etc.

- Either Income for cash in or Payout for

cash out.

- Select the Category from pre-defined category for

your expenses, eg SALARY, CAPITAL, RENTAL, etc.

- Category can be filter at Expenses Report.

- Click

button to save the entry.

button to save the entry.

- Click

button to remove expenses record.

button to remove expenses record.

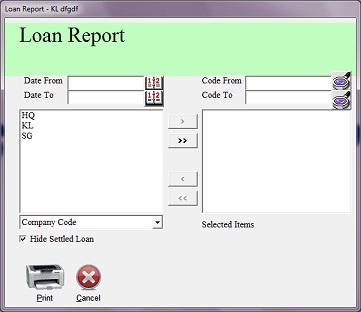

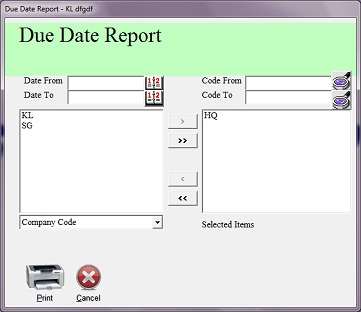

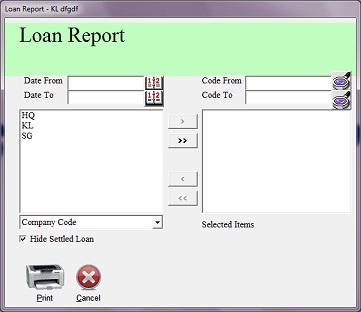

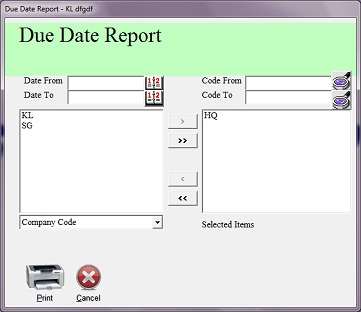

Reporting

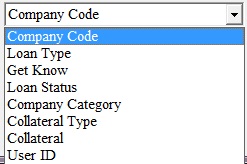

- All report having the standard input function

- Date From and Date To allow user to choose

any date range of the report.

- For Due Date Report the Date From can leave

blank with just Date To to print overall outstanding loan due as at

Date To.

- Code From and Code To will depend report

type, eg. customer profile will be customer code, loan report will be loan

code

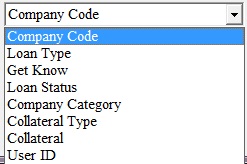

- Further drill down the report by selection items from

pre-define selection eg company code, loan type, etc.

- Click

to select single item or

to select single item or

button to select all items to make selection, eg as below image.

button to select all items to make selection, eg as below image.

- Click

button to print the report.

button to print the report.

Button to login.

Button to login. button to abort.

button to abort.

button.

button.

button to save customer profile, customer code will be auto generated.

button to save customer profile, customer code will be auto generated. button.

button.

button to get the Customer Code.

button to get the Customer Code. button to temporary save Reference details into Reference List and ready

for next Reference detail.

button to temporary save Reference details into Reference List and ready

for next Reference detail. button to remove unwanted Reference detail.

button to remove unwanted Reference detail. button to clear Reference detail and ready for next Reference.

button to clear Reference detail and ready for next Reference. button to save customer profiles otherwise all new added Reference will not

be save into database.

button to save customer profiles otherwise all new added Reference will not

be save into database. button.

button.

button to save to entry.

button to save to entry. to retrieve customer loan and guarantor information.

to retrieve customer loan and guarantor information. button.

button.

button to search from existing customer profile, or

button to search from existing customer profile, or button to read from guarantor MyKad, or

button to read from guarantor MyKad, or

button to print loan documents.

button to print loan documents.

button.

button. button.

button.

button to save the payment record.

button to save the payment record.

button to save to entry, the conversion will be store in the bottom list

which can be double click to show up again.

button to save to entry, the conversion will be store in the bottom list

which can be double click to show up again. button to view the customer profile.

button to view the customer profile. button to view loan detail.

button to view loan detail.

button to search existing expenses record.

button to search existing expenses record. button to save the entry.

button to save the entry. button to remove expenses record.

button to remove expenses record.

button to print the report.

button to print the report.